Trust Tax Returns

If you have maintained the accounts for your trust in an accounting system like MYOB Account Right/Essentials, Excel or any other systems, Xero or QuickBooks Online you can use LodgeiT to easily prepare the trust tax return, handle profit distributions and even check that the accounting data is prepared accurately using the integrated working paper module.

LodgeiT makes lodging your company tax return simple with just 7 steps to get started:

STEP 03

Register for an MyGovId if you don’t have one

STEP 06

Lodge your trust tax return!

STEP 04

Connect LodgeiT to the Australian Tax Office

Detailed instructions for completing your Trust Tax Return

Sign-up & try the LodgeiT Trust Tax Return Wizard now.

You can do this by following some simple steps as laid out in our Help Guide for Trusts (See below) and our Best Practice Accounting Guide.

The guide will provide you with a helpful set of instructions for dealing with all manner of accounting complexities including handling depreciation to recording tax liabilities correctly.

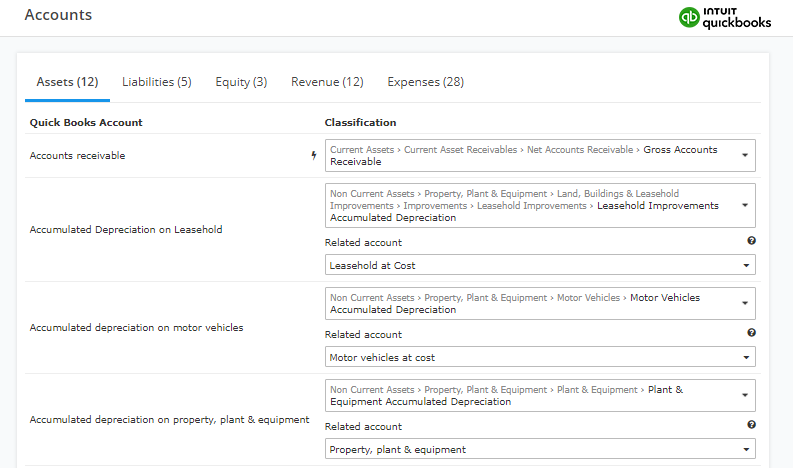

Using LodgeiT, easily import accounts from any popular accounting software. (If you have Xero, QuickBooks Online or MYOB Account Right Live, we make this process fully automatic).

Once your accounts have been imported, you will be prompted to deal with any accounts that LodgeiT finds ambiguous. i.e. you might have a line item in the liabilities section of your source accounting system balance sheet named Loan.

You will be prompted to map the account to make it more meaningful to LodgeiT i.e. is it a loan to a company, a partnership or another individual? Then is the loan from a related party or not?

So you should pay attention to the names of the accounts that you create in your source accounting system i.e. instead of just Loan, add the name of who the loan is from, say Loan – XYZ Pty Ltd if it is a loan to a company of the name XYZ

When a business owner decides to lodge their own tax return, they should consider the following general points:

Determine the need to lodge: : Ascertain whether the business is required to lodge a tax return for the relevant income year. This is obligatory for most businesses that operate within Australia, regardless of whether they have made a profit or incurred a loss.

Understand the due dates: For self-prepared lodgments, the due date is typically 31 October. Engaging a registered tax agent for lodgment often affords businesses an extended due date, but businesses must engage the services of a tax agent before 31 October to benefit from this extension.

Choose the method of lodgment: Business owners can lodge their tax returns through various methods, including using myTax for sole traders, SBR-enabled software for companies, trusts, or partnerships, or by paper.

Gather all relevant information: Before lodging the tax return, ensure that all necessary financial records, including income, deductions, and tax credits, are accurate and complete.

Reporting accurately: Make sure to report all assessable income while understanding what income to include and exclude. Claim legitimate business deductions and ensure that you have apportioned expenses correctly where they have both a business and private use component.

Keep good records: Maintaining proper and complete records is essential, as it helps to substantiate claims made in the tax return. Records must be kept for at least five years.

Calculate the correct amounts: Ensure accurate calculation of income, deductions and the tax owing or refund due. Utilize the correct rates and thresholds where applicable.

Review the return: Double-check the tax return for accuracy before lodging. Even if using a tax agent, the business owner is ultimately responsible for the correctness of the information in the return.

Lodge on time: Ensure that the tax return is lodged prior to the due date to avoid any late lodgment penalties.

Understand obligations: Acknowledge the business owner’s responsibility for what’s reported in the tax return, even if assistance is used to prepare it.

Plan for liabilities: If a tax bill is expected, plan beforehand to meet the payment deadline and avoid incurring interest charges and penalties.

Know your entitlements: Understand the various concessions, offsets, and reliefs available to businesses to optimize the tax position.

Seek help if needed: If in doubt, contact the ATO or consult a tax professional. Eligible business owners may also consider the ATO’s Tax Help program for free assistance.

Consider changes in law: Keep abreast of any tax law changes that may affect the business tax return for that income year.

Use available resources: Utilize the tools and calculators provided by the ATO, such as the ‘Fuel tax credit calculator’, to simplify the calculation of complex items like fuel tax credits.

Example of the mapping process for account line items in a trust:

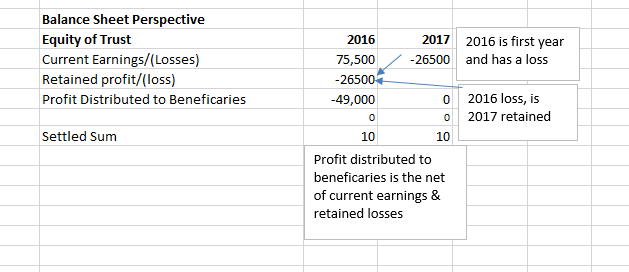

An important aspect of accounting for trusts is to recognise that the equity section of a trust balance sheet usually only reflects the original settled sum used to bring a trust into existence and in the case of a loss, the retained loss. Typically, trust profits are distributed among the beneficiaries and losses are retained in order to be offset against future profits.

Balance sheet perspective of equity of a trust:

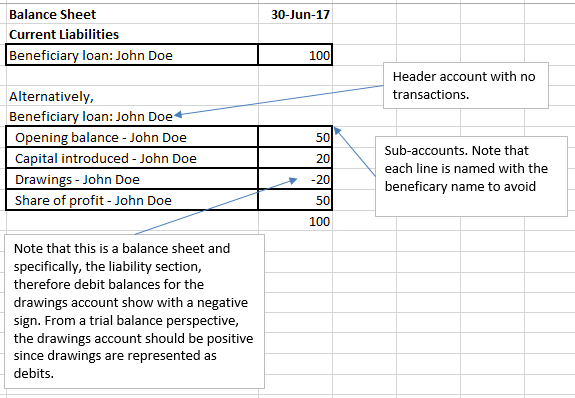

In your source accounting system, you should create accounts for beneficiaries in the liability section.

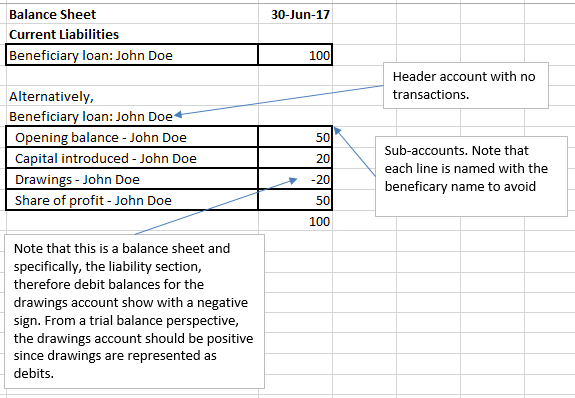

You have two options

1

The first option is to simply have a single line item for each trust beneficiary i.e. Beneficiary loan – Andrew or Beneficiary loan: Andrew.

2

The second option is to create sub accounts for each beneficiary in order to segregate transactions by way of their nature, typically along the lines of beneficiary contributions (capital Introduced), beneficiary share of profits, and payments for the benefit of a beneficiary (drawings).

Representing the beneficiary loan account – Two different methods :

Bear in mind that most accounting software is not designed to roll the beneficiary loan account sub-ledgers and therefore you will be required to post an additional set of manual journal transactions to close out the balance sheet at the end of any given reporting period.

Bear in mind that most accounting software is not designed to roll the beneficiary loan account sub-ledgers and therefore you will be required to post an additional set of manual journal transactions to close out the balance sheet at the end of any given reporting period.

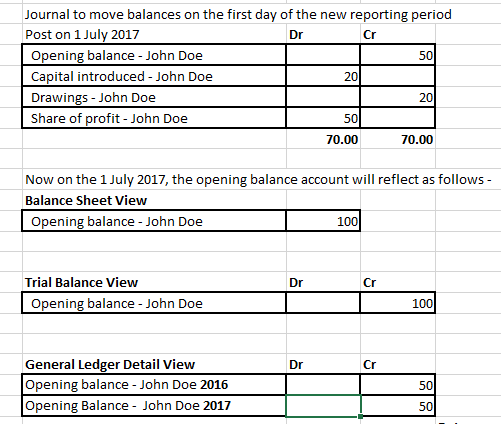

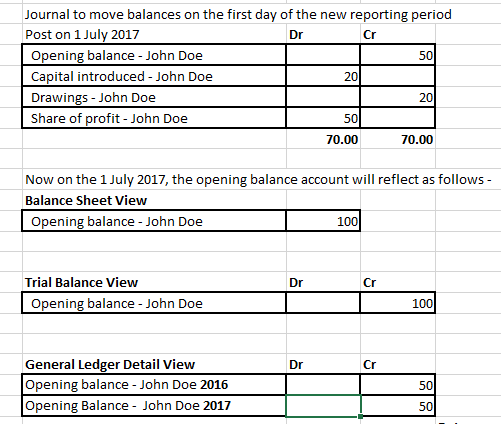

Now for our trust, we need to allocate profits to the respective beneficiaries in accordance with the trust distribution minutes using the following journal at the end of any given reporting period i.e. financial year.

Journal to properly reflect beneficiary loan balance adjustment new reporting period :

The alternative is quite simple. Don’t use sub-accounts. Just report all transactions through the single account for the beneficiary in order to avoid the requirement to handle closing period adjustments.

To gain a better perspective of trust accounting, you may wish to watch our trust accounting video series.

LodgeiT provides special purpose accounts that allow you to easily reflect the primary trust beneficiary accounts including profit, drawings / maintenance payments and capital / funds introduced.

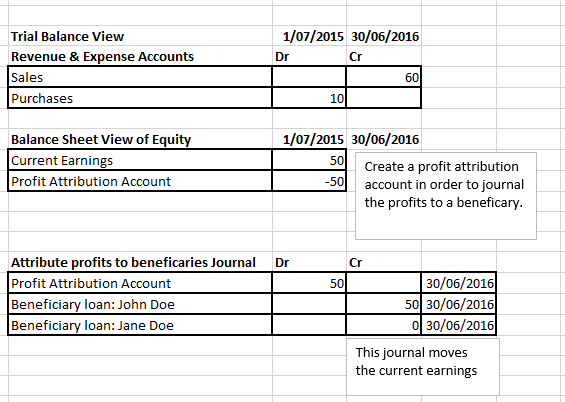

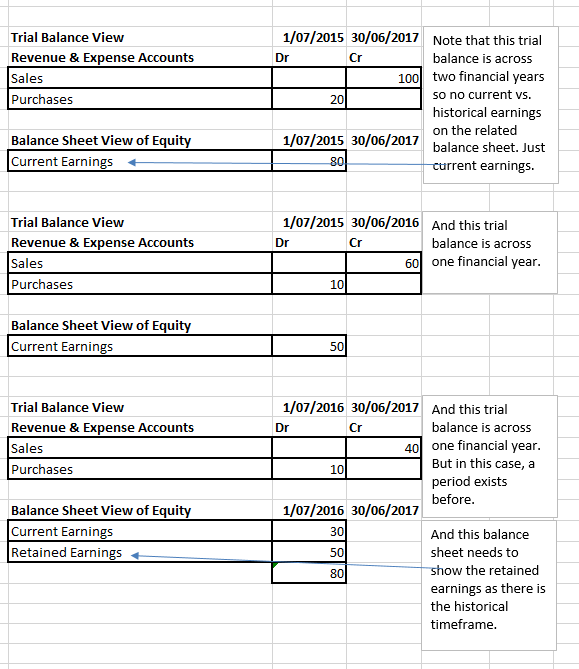

Cloud-based accounting systems including Xero, MYOB Account Right Live & QuickBooks Online are designed for profits to accumulate and reflect in the equity section. The following views of trial balance & equity sections shows only the relevant parts.

Journal to properly reflect beneficiary loan balance adjustment new reporting period:

The alternative is quite simple. Don’t use sub-accounts. Just report all transactions through the single account for the beneficiary in order to avoid the requirement to handle closing period adjustments.

To gain a better perspective of trust accounting, you may wish to watch our trust accounting video series.

LodgeiT provides special purpose accounts that allow you to easily reflect the primary trust beneficiary accounts including profit, drawings / maintenance payments and capital / funds introduced.

Cloud-based accounting systems including Xero, MYOB Account Right Live & QuickBooks Online are designed for profits to accumulate and reflect in the equity section. The following views of trial balance & equity sections shows only the relevant parts.

Profit Attribution for trust :